When should you send one?

Why this is particularly important in a debt recovery process especially if you’re a business owner?

You’ve done business, you’ve done a service, you’ve sold a product to a customer and now the customer has not paid you.

What steps should you take in the debt recovery process?

Usually, you send a letter of demand after you’ve already approached the debtor. It can be a customer, someone you’ve lent money, to a family member, a friend, whatever the case is and they’ve still not paid you.

In other words, you’ve sent them a text message, you’ve sent them an email, or you’ve requested payment in some form or another.

This article will discuss, what is a letter of demand and when you should consider sending one?

When should you send a letter of demand?

The most important thing is, if you’re in business you need a clear accounts process. It is important to know the sales for the month and what is outstanding.

Once you know your outstanding accounts, then you’ve also taken steps to notify those customers to pay you. They failed to pay you and then you send a letter of demand.

The purpose of the letter of demand is a legal document to get paid and also a way to preserve your business relationship as much as possible.

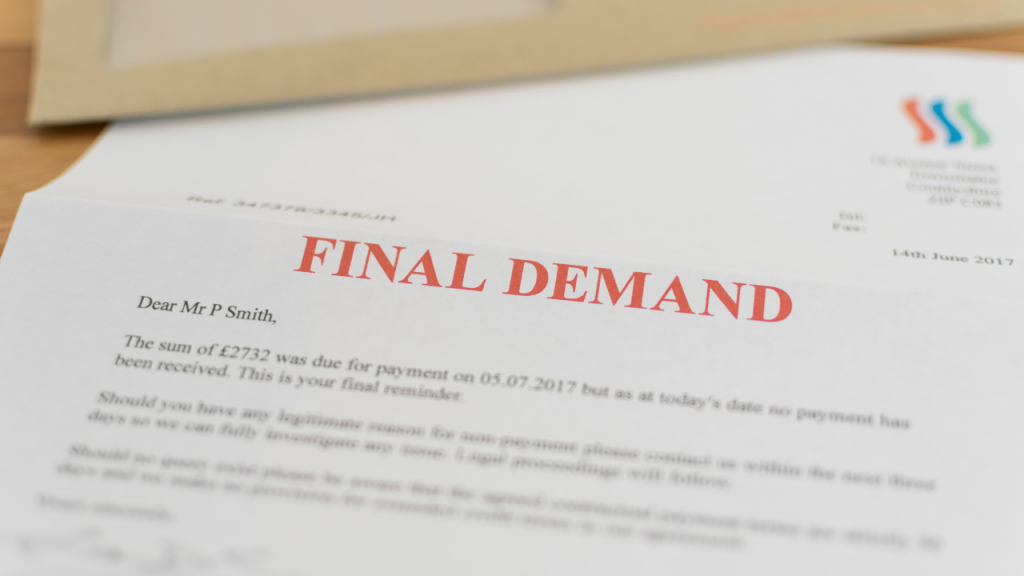

A letter of demand, in essence, should be a final letter where you’re giving this other person an opportunity to pay you the money, before taking legal action.

In other words, before you go and see your lawyer. The reason why is once you send the letter of demand and they haven’t paid, you then must follow through on your word. You’ve got to then make sure you either issue a summons or you take some other legal step to recover that money.

What should a letter of demand include?

You should first make sure that you address the letter of demand to the right person. In other words, you want to make sure that you send the letter of demand to the decision-maker of that business or that client.

Don’t send the letter of demand to the sales rep or to the customer liaison agent. You need to send it to the managing director or the owner of that business because that person has the power to decide to pay you or not.

If you have the correct address details, the other important aspect that goes into a letter of demand is how much money is outstanding to you, and your bank account details, so that they can make payment and the consequences. The most important consequence of not paying you the outstanding amount.

Can you claim interest in the letter of demand?

Yes, if it’s part of your contract terms and conditions of your business or a loan that you’ve issued out, you can claim the interest amount that is owing to you.

What is the checklist for sending a letter of demand?

- When sending a letter of demand, ensure that you do the following:

- Ask the person to pay you in clear terms, don’t mince your words.

- Give them the amount that they owe.

- Clearly state in the letter that you intend to take legal action if they do not pay you.

- Give them a date to make payment.

- Attach all supporting documents, for example invoices that prove your case.